Bagley Risk Management : Protecting Your Business Future

Wiki Article

Just How Animals Danger Protection (LRP) Insurance Policy Can Secure Your Animals Investment

Livestock Danger Security (LRP) insurance policy stands as a dependable shield against the uncertain nature of the market, offering a tactical method to securing your possessions. By diving right into the details of LRP insurance policy and its multifaceted benefits, animals producers can strengthen their financial investments with a layer of security that goes beyond market variations.Understanding Livestock Threat Defense (LRP) Insurance Policy

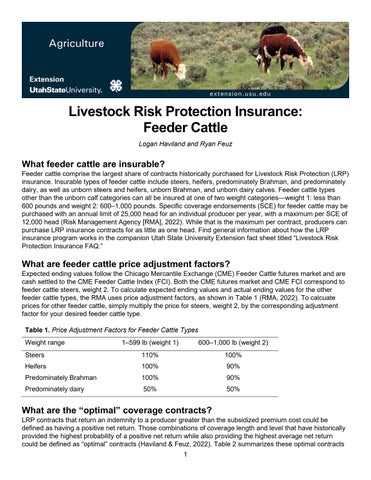

Comprehending Livestock Threat Security (LRP) Insurance is essential for animals manufacturers wanting to mitigate monetary risks connected with price fluctuations. LRP is a federally subsidized insurance policy product made to secure manufacturers versus a decrease in market rates. By supplying coverage for market value declines, LRP assists manufacturers secure a flooring price for their animals, guaranteeing a minimal level of earnings no matter market variations.One key element of LRP is its flexibility, permitting producers to personalize coverage levels and plan lengths to match their particular demands. Producers can pick the number of head, weight array, protection price, and insurance coverage period that align with their manufacturing objectives and run the risk of resistance. Understanding these adjustable options is crucial for manufacturers to effectively manage their cost threat exposure.

In Addition, LRP is offered for numerous livestock types, consisting of livestock, swine, and lamb, making it a versatile danger monitoring tool for livestock manufacturers throughout various markets. Bagley Risk Management. By familiarizing themselves with the ins and outs of LRP, manufacturers can make informed choices to protect their investments and make certain monetary stability in the face of market unpredictabilities

Benefits of LRP Insurance Policy for Livestock Producers

Livestock manufacturers leveraging Livestock Risk Defense (LRP) Insurance policy gain a tactical advantage in shielding their financial investments from cost volatility and securing a secure monetary footing among market uncertainties. By setting a flooring on the price of their livestock, manufacturers can reduce the danger of substantial economic losses in the event of market downturns.

In Addition, LRP Insurance provides producers with assurance. Understanding that their financial investments are guarded versus unforeseen market adjustments enables manufacturers to concentrate on various other aspects of their service, such as boosting pet health and wellness and welfare or maximizing production procedures. This assurance can bring about increased efficiency and productivity over time, as manufacturers can run with more self-confidence and security. On the whole, the benefits of LRP Insurance policy for animals producers are significant, using a valuable device for handling danger and making certain monetary safety in an unforeseeable market atmosphere.

Exactly How LRP Insurance Mitigates Market Risks

Alleviating market risks, Livestock Threat Defense (LRP) Insurance offers livestock manufacturers with a dependable guard versus cost volatility and financial unpredictabilities. By offering defense against unforeseen price drops, LRP Insurance coverage helps weblink manufacturers secure their investments and preserve monetary stability in the face of market changes. This type of insurance policy permits animals producers to secure a cost for their pets at the beginning of the plan duration, ensuring a minimum rate degree no matter of market modifications.

Steps to Protect Your Animals Investment With LRP

In the realm of farming risk management, applying Livestock Threat Security (LRP) Insurance coverage involves a strategic procedure to safeguard investments against market changes and uncertainties. To protect your animals investment efficiently with LRP, the initial step is to analyze the certain risks your procedure faces, such as rate volatility or unexpected weather condition occasions. Next, it is critical to research and select a respectable insurance policy company that uses LRP plans customized to your livestock and organization demands.Long-Term Financial Protection With LRP Insurance Policy

Ensuring withstanding economic security through the use of Livestock Risk Protection (LRP) Insurance is a sensible long-term method for farming manufacturers. By including LRP Insurance policy right into their threat administration plans, farmers can guard their animals investments against unanticipated market variations and negative events that could jeopardize their monetary health gradually.One trick benefit of LRP Insurance for lasting economic security is the satisfaction it provides. With a trustworthy insurance plan in area, farmers can reduce the economic risks connected with unstable market conditions and unforeseen losses because of factors such as illness episodes or natural calamities - Bagley Risk Management. This security allows manufacturers to concentrate on the everyday operations of their livestock service without consistent bother with prospective financial troubles

In Addition, LRP Insurance coverage offers an organized strategy to managing danger over the lengthy term. By setting specific coverage degrees and selecting proper endorsement periods, farmers can tailor their insurance policy plans to straighten with their economic objectives and run the risk of i thought about this resistance, guaranteeing a protected and lasting future for their animals operations. Finally, purchasing LRP Insurance is an aggressive method for farming manufacturers to accomplish long-term economic protection and safeguard their source of incomes.

Conclusion

In conclusion, Animals Danger Protection (LRP) Insurance policy is a valuable tool for animals manufacturers to minimize market dangers and secure their investments. It is a wise selection for guarding livestock investments.

Report this wiki page